is inheritance taxable in utah

If the grantor acted as trustee while. However you may still become responsible for a federal gift tax due.

Utah Inheritance Laws What You Should Know

However inheritance laws from other states may apply to you if someone from a state with an inheritance tax leaves you something.

. This chapter is known as the Inheritance Tax Act Renumbered and Amended by Chapter 2 1987 General Session 59-11-102 Definitions. There is no federal inheritance tax but there is a federal estate tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

Inheritance taxes are relatively rare. Processed items - Such as products that were processed by third parties and have more value than their original precious metals content eg. The result is that the total amount of federal estate tax and Utah inheritance tax is no greater than if there were no Utah inheritance tax at all.

The assets of the estates exceed 100000 in value. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Income from Utah sources is taxable in Utah during the period of nonresidency.

Utah does not levy an inheritance tax. It depends on the kind of probate that is open and how complicated the estate is. If you purchase taxable goods or services in Utah your transaction includes both a state and local sales tax.

In Utah the inheritance tax is not levied. If you inherit property or money from someone out of state ensure. Inheritance taxes are paid at the beneficiary level after any estate taxes have been paid after settling estate taxes.

The issue of Social Security is a concern particularly for retirees who dont have significant investment and retirement accounts. However if someone from a state that collects inheritance tax leaves your property then you have to pay for the fee. Inheritances that fall below these exemption amounts arent subject to the tax.

Probate can be as short as five months or take a couple of years. TC-90CB Renter Refund Circuit Breaker Application to be filed with Tax Commission TC-90CY Indigent Abatement and Property Tax Credits Application to be filed with your county. Pennsylvania for instance has inheritance laws that apply to out-of-state inheritors.

However a beneficiary who lives in another state may have to pay inheritance tax if the beneficiarys state of residence charges an inheritance tax even though. 2 Federal credit means the maximum amount of the credit for state death taxes allowed by Section 2011 in respect to a decedents taxable estate. Native Americans who earn income in Utah must file a Utah tax return.

Taxable unearned income may include. Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to.

Tips for Changing Your Tax Residence in Utah Is Social Security Taxable in Utah. Most counties charge an additional 25 in sales tax. Special domicile rules apply to service members and their spouses.

Thankfully there is no state inheritance tax in Utah. Charges an additional. Reporting inheritance income in respect of a decedent includes gross.

1 Decedent means a deceased natural person. Most states dont levy an inheritance tax including Utah. Sales taxes in Utah range from 610 to 905 depending on local rates.

In 2022 only six states have an inheritance tax. Utah does not collect an estate tax or an inheritance tax. Inheritance tax applies to the money after it has been disbursed to the beneficiaries who are responsible for paying taxes.

However state residents must remember to take into account the federal estate tax. 3- Is There An Inheritance Tax In Utah. Thus if there is no federal estate.

However if the inheritance is considered income in respect of a decedent youll be subject to some taxes. See Pub 57 Military Personnel Instructions. An estate taxes the value of the property at the time someone dies leading some people to call it a death tax.

As used in this chapter. Check local laws if you inherit money or property from someone living out of state. Utah does not collect an estate tax or an inheritance tax.

A Guide To Inheritance Tax In Utah Maryland is the only state to impose both. The Utah Uniform Probate Code UPC stipulates that probate is necessary when. The current state sales tax is 485 and the local sales tax is 1.

This means that the amount of the Utah tax is exactly equal to the state death tax credit that is available on the federal estate tax return. Its always better to. You may also want to read.

However state residents must remember to take into account the federal estate tax. Estate tax works differently and is more common. Utah does have an inheritance tax but it is what is known as a pick-up tax.

The good news for Utah residents the state does not have any gift tax. However if the deceased had property in Iowa Kentucky Maryland Nebraska New Jersey or Pennsylvania the six states which still currently maintain estate tax heirs in Utah could be taxed on assets over 25000. What Does In Respect of a Decedent Mean.

If you are filing the deceased taxpayers return as single married separate head of household or qualifying widow er and they died in 2021 or 2022 before filing the tax return enter the taxpayers date of death mmddyy on the first line of TC-40 page 3 Part 1. Best of all there is no inheritance or estate tax in Utah which can be advantageous for retirees. If you are the surviving spouse filing a joint return.

Inheritance tax is a state tax on money or property left to others after someone dies. In fact people are making taxable gifts and some of them dont even realize it. The estate has real property such as a house or land or.

Certain income earned by Utah Native Americans may be exempt from Utah income. The following pages and forms give helpful tax information for retirees and seniors. Lets see how federal gift tax legislation works in Utah and other similar states that dont impose the state gift tax.

Some locations in Utah charge additional sales tax such as the following.

Children S Rights In Divorce Divorce Utah Divorce Divorce Lawyers

Historical Utah Tax Policy Information Ballotpedia

What Is An Undisputed Divorce In Utah Utah Divorce Divorce Lawyers Divorce Settlement

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Child Custody Battles Custody Lawyer Child Custody Family Law Attorney

Utah Estate Inheritance Tax How To Legally Avoid

Utah Estate Tax Everything You Need To Know Smartasset

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Divorce Attorney

Utah Estate Tax Everything You Need To Know Smartasset

Voices For Utah Children State Estate Taxes A Key Tool For Broad Prosperity Estate Tax Inheritance Tax Prosperity

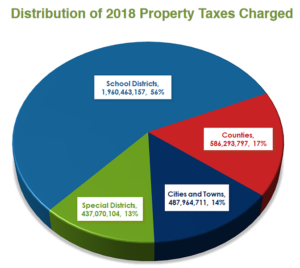

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Utah Estate Tax Everything You Need To Know Smartasset

Judicial Vs Non Judicial Foreclosure Utah Divorce Lawyers West Jordan Utah

Is There An Inheritance Tax In Utah

A Guide To Inheritance Tax In Utah

Adoption Taxpayer Identification Number Family Law Attorney Divorce Lawyers Divorce Attorney

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account